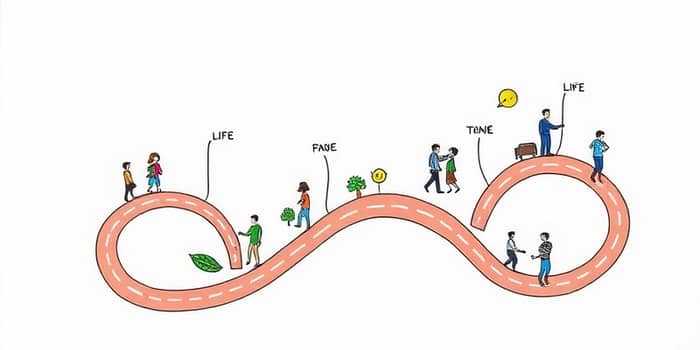

In an ever-changing world of financial ups and downs, taking charge of your money requires a clear roadmap. A lifelong financial journey means anticipating challenges, seizing opportunities, and adjusting strategies at every turn.

By proactively planning and learning about key concepts, you can build confidence and resilience. Whether you’re opening a first savings account or navigating retirement withdrawals, each decision shapes your financial legacy.

Understanding Your Financial Lifespan

Financial priorities shift as you age. Recognizing distinct life stages helps you align actions and goals to current circumstances. Below is a common breakdown:

- Formative/Teenage Years (13–17)

- Young Adulthood/Early Career (18–25)

- Family/Early Family Building (26–45)

- Peak Earning/Mid-Life (40s–50s)

- Pre-Retirement (50s–64)

- Retirement & Post-Retirement (65+)

Stage 1: Formative Years (13–17)

Goals in these years focus on open your first savings account and grasping basic money concepts. Teens learn to budget, track expenses, and differentiate real needs and fleeting wants.

Challenges include limited income and peer pressure. Only about one third of teens report feeling very confident managing money. Building early habits of saving and understanding interest lays a foundation for future investing.

Stage 2: Young Adulthood/Early Career (18–25)

Entering the workforce or college, your goals shift toward financial independence. Key actions include managing student loans (average U.S. grad debt: $29,400) and build your emergency fund early to cover unexpected expenses.

Adopting a basic budget—such as the 50/30/20 rule—ensures essential needs are met, while you begin contributing to employer retirement plans or IRAs. Establishing credit responsibly and monitoring your score (aim for 700+) sets up better lending rates down the road.

Stage 3: Family/Early Family Building (26–45)

As life becomes busier, priorities include buying a home (median U.S. price: $420,000), funding education, and balancing work and childcare costs (average annual daycare: $11,000+). It’s crucial to balance family expenses and long-term savings.

Opening 529 college accounts, updating wills, and carrying adequate insurance—life, disability, and home—protects your household from unforeseen events. Combining incomes and setting shared financial goals with a partner enhances stability and teamwork.

Stage 4: Peak Earning/Mid-Life (40s–50s)

In your peak earning years, focus on maximize retirement contributions with catch-up allowances. The IRS allows an extra $7,500 catch-up contribution for those 50 and older in 2025. Review your asset allocation and consider adding long-term care insurance.

Many face “sandwich generation” pressures—supporting both children and aging parents. College tuition (in-state public average: $11,000/year) and care costs can strain budgets. Reassess risk tolerance and diversify investments to withstand market cycles.

Stage 5: Pre-Retirement (50s–64)

Preparing for retirement means optimizing tax strategies and eliminating debt. Decide when to claim Social Security (full retirement age: 66–67) and estimate your retirement income needs accurately—usually 70–80% of pre-retirement earnings.

Healthcare costs before Medicare eligibility can be high. Plan for premiums, consider Health Savings Accounts (HSAs), and protect against sequence-of-returns risk by maintaining a conservative allocation for funds you’ll draw first.

Stage 6: Retirement & Post-Retirement (65+)

Once retired, your goals shift to efficient withdrawals and wealth preservation. Take required minimum distributions (RMDs) on schedule, apply the 4% rule as a starting point, and manage longevity risk and withdrawal rates.

Estate planning—wills, trusts, powers of attorney—and preparing for long-term care (median nursing home cost: $108,000/year) are essential. By 2040, more than 80 million Americans will be 65 or older, making these steps critical for financial security.

Retirement Savings Benchmarks by Age

Use these guidelines to measure your progress against Fidelity’s recommendations:

Actionable Steps to Take Now

Regardless of your life stage, these five steps can help you stay on course:

- Assess assets, debts, income, and expenses.

- Set SMART goals: short-, medium-, and long-term.

- Create a written plan with timelines and milestones.

- Automate savings and investment contributions.

- Review and adjust your plan at least annually.

Tools and Resources

Tapping into the right tools can simplify your journey. Consider popular budgeting apps and calculators to conduct annual financial health check-ups and stay accountable.

- Mint, YNAB, or similar budgeting platforms.

- Online retirement and 529 college savings calculators.

- Financial literacy courses and professional advisors.

By mapping out each phase—understanding challenges and seizing opportunities—you transform uncertainty into confidence. A lifelong approach empowers you to adapt, protect what matters, and leave a lasting, positive legacy.

References

- https://smartasset.com/advisor-resources/financial-planning-life-cycle

- https://imarticus.org/blog/financial-planning-for-different-life-stages/

- https://www.asset-map.com/blog/life-cycle-financial-planning

- https://www.rwroge.com/2023/11/how-life-changes-affect-your-financial-planning-needs/

- https://guides.loc.gov/personal-finance/life-stages

- https://incomelaboratory.com/understanding-life-cycle-financial-planning/

- https://news.northwesternmutual.com/planning-and-progress-study-2023

- https://williambevins.com/the-comprehensive-guide-to-financial-planning-steps-strategies-and-expert-insights/

- https://www.financialplanningassociation.org/article/journal/SEP21-importance-managing-life-stage-risks-aging-population

- https://ffin.com/articles-financial-education/life-stages-strategies

- https://www.usbank.com/financialiq/manage-your-household/personal-finance/financial-planning-guide-for-today-and-future.html

- https://www.acg.aaa.com/connect/blogs/5c/money/guide-to-financial-planning-for-every-stage-of-life